Commodity prices have been on the rise in the second quarter of this year, with the inflation rate reaching double digits. The real estate market has been affected, albeit in a healthy way, by this price growth and the growing housing shortage.

Due to people’s historical tendency to seek out assets that act as a buffer against inflation, the real estate market typically does well in this type of inflationary climate.

Avenue5 International, Pakistan’s most intelligent property portal, offers a thorough examination of various property investments and how they might aid in keeping pace with inflation to look at the impact of inflation on real estate.

What Is Inflation?

The term “inflation” describes a decrease in people’s ability to make purchases as a result of an overall rise in the cost of goods and services.

Your ability to spend lessens as the value of your money decreases due to rising inflation. Therefore, the rate of change in those prices over a period of time might be referred to as inflation.

Causes of Inflation:

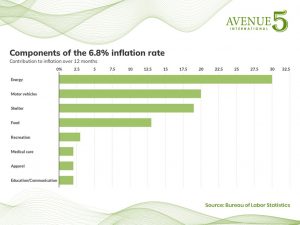

Over the course of this year, inflation is predicted by the International Monetary Fund (IMF) to average 11.5 percent in developing nations and 7.5 percent in industrialised nations.

The Ukraine conflict and interruptions to the global supply chain are the two main causes of this jump in inflation, while other factors may also be to blame. The yearly global inflation rate has reached its highest level since 1981 as a result of these two variables.

In Pakistan, however, there are other interrelated causes that have contributed to this sudden increase in inflation, most notably the balance of payment (BOP) problem.

The government was forced to turn to the IMF for assistance in order to deal with this. However, the IMF has not yet approved the loan tranche for the nation, which has caused the inflation rate to increase even further.

To control the payment balance, the government recently raised the cost of fuel and electricity. However, this price increase has raised commodity prices, which has an effect on many domestic industries.

Inflation Impact on Real Estate Market:

In contrast to other industries, real estate is most affected favorably by inflation. Real estate investors have historically been unaffected by rising inflation; in fact, they stand to gain the most from it. People with lesser incomes are particularly affected by the era of high inflation.

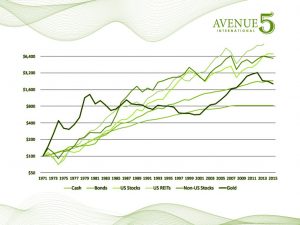

Most investors utilize real estate as a hedge against inflation during periods of high inflation since it provides greater protection than other assets like equities, gold, cryptocurrencies, etc.

To be clear, though, this time can also have some bad effects. The list of some favorable and unfavorable outcomes we have provided below is meant to help better clarify the effects of inflation.

Property Appreciation:

The value of the properties has increased significantly over the past few years, according to data on real estate. For instance, a property purchased in 2018 for $1 million might now be worth $5 to $6 million.

Any real estate investment would have easily outperformed inflation if we assume this rise in the property’s value and compare it to inflation rates.

However, real estate investing requires caution because you don’t want to leave money in holdings that might not generate higher returns. It is crucial to remember that real estate investment is ineffective in the short term because it takes time for a property’s value to increase. If you want to earn profitable profits over the long term, you must keep the properties for a while.

Increase in Rents:

Rental rates typically rise in tandem with growing inflation, just like the pricing of other commodities. Due to a decline in people’s purchasing capacity, there is a rise in demand for rental houses, which is why this occurs.

Property owners with rental revenue will be able to cover the rise in costs regardless of the value of the currency or the rate of inflation.

Negative Impacts of Inflation on Real Estate:

The following are a few detrimental effects of inflation on real estate.

Rising Cost of Construction:

The rising cost of all building supplies, such as steel, cement, and bricks, is one factor that has a detrimental effect on real estate. The cost of constructing a home or other building has increased significantly since the prices of these components climb in lockstep with inflation.

Increased rate of Borrowing:

With growing inflation, the majority of central banks typically raise interest rates. This has an impact on borrowing costs for people trying to fund real estate purchases. In this inflationary economy, building a new house will be challenging due to the rise in borrowing and construction prices.

Best Real Estate Investments in Inflationary Environment:

Real estate investments are market-dependent, but some assets, notably rental properties, perform better than others. These include residential and commercial properties, which despite current global inflation are projected to see stronger demand and profits.

Another option for allocating wealth across various assets is to invest in REITs (Real Estate Investment Trusts).

Although investing in real estate shields you against inflation, it is important to note that this is not a short-term strategy. As property prices only rise after four to five years, you must plan for the long term.

Visit Avenue5 International if you want to know more about us, and Times Square & The Dunes Mall for our projects information.